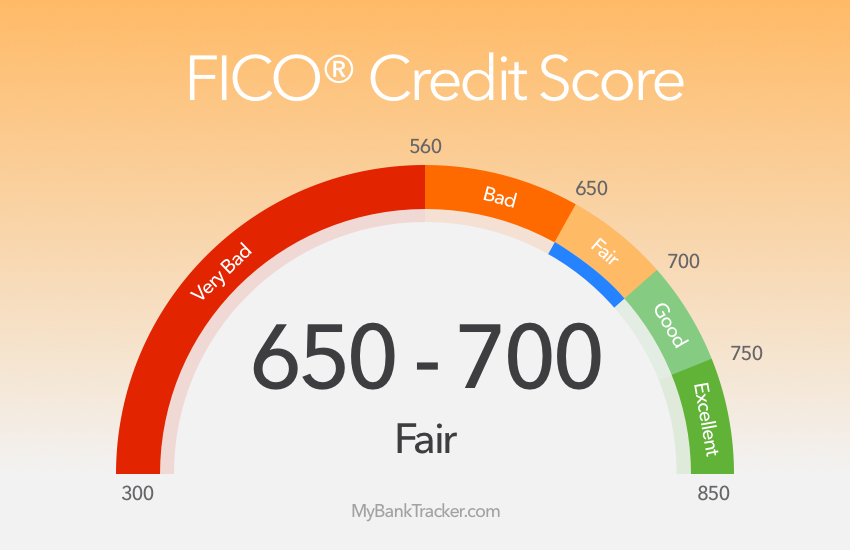

How will you pay for the construction of your dream home? Construction loans 101-- BYHYU 04712/7/2016 Most people don’t have the means to pay cash for the construction of their new homes, so most folks will need to take out a construction loan. We’ll talk about the different options for financing new construction in this week’s mini lesson. Shout out to George, who left me a really sweet email and requested this topic. This one’s for you, George. Before we move on to the mini lesson, let's go over our Pro Terms: Conforming loan and Non-conforming loan A conforming loan is a mortgage for less than $424,100 and a non-conforming loan is $424,100 or more. $424,100 seems like such a random number, doesn’t it? But that’s what the lenders go by. In a few areas of the US where housing prices are really high, the amount of a conforming loan is higher. Non-conforming loans are also called jumbo loans. As you can imagine, it’s more difficult to find a lender that will approve you for a non-conforming, jumbo loan. Getting approved for a jumbo loan can be more challenging because the rules and criteria for the loan are stricter. So, again, a conforming loan is less than $424,100 and a non-conforming loan, also called a jumbo loan, is $424,100 or more. Up next is this week’s mini lesson. Back in the day, it wasn't unusual for a builder to obtain and carry the construction loans for their clients. Nowadays, that doesn’t happen very often. So it’s usually the homeowners’ responsibility to get a construction loan if they want to build. Construction loans are short term loans that usually last no longer than one year. If more time is needed, you can apply for an extension. Construction loans usually have variable rates that increase and decrease as the prime rate increases and decreases. The rates on a construction loan are higher than rates on a permanent, traditional mortgage. Construction loans are essentially a line of credit, like a credit card, but with the bank is controlling when money is borrowed and released to the contractor. When applying for a construction loan, both the homeowner and the contractor must be approved. Most lending institutions require that a licensed builder be involved in constructing the home. The bank wants to make sure that you can afford the loan and that the contractor has the financial strength and skills to get the house built on time and on budget. The bank also wants to know that the finished house and land will appraise for at least the amount of the mortgage. If you have your heart set on being your own builder, but also want lender financing, you have a couple options. First, you can borrow from a lender that specialized in owner-builder projects. Just do a google search and research some of the options that pop up. Another thing you can do is hire a licensed contractor as a consultant, instead of as the primary builder. That way you’ll have an experienced contractor’s name on paper and you’ll have someone on site to trouble shoot any problems that arise. That’s usually enough to make the lender comfortable. Finally, you could save for several years and pay cash for your new house, so you don’t have to worry about getting approval from a lender. I know that’s not the American way, but it is an option. You could flip several houses over several years and save your profits to build his own house. Of course, that assumes that you make a profit on your house flips. To qualify for a construction loan, most banks require that the house being built will be an owner-occupied primary or secondary residence. The house must be a detached, single-family home. It is not unusual for banks to only lend 80% or less of project cost, meaning you’d have to come up with a downpayment of 20% or more. If you already own your land outright, the land can serve as equity and can be counted toward that 20% downpayment. Construction loans represent only a very small fraction of home loans. Most home loans are mortgages for existing houses. Construction loans are a much bigger risk for lenders because a homeowner is more likely to walk away from a house under construction than a house that is already complete. And, if a homeowner walks away from an incomplete house, the bank is stuck with an unfinished project. Therefore, lenders are not aggressively marketing construction loans. Instead, you’ll have pound the pavement and go to your local lending institutions to acquire a construction loan. Regional banks and credit unions are typically the best sources. To get started in the approval process, you need most or all of the following. 1. A copy of a construction agreement with your builder, which must specify the cost of your home including options, upgrades and lot value. 2. A land contract for the lot on which your house will be built, or the deed to the lot, if you own the land. You may be able to get a construction loan before you choose your lot. Just talk with the institutions you are considering to see a lot is required for approval. 3. A detailed copy of the your house plans. 4. Copies of your bank statements, paycheck stubs and/or your tax returns from the last few years. 5. Your FICO credit score The higher your credit score and the bigger your downpayment, the more likely you are to be approved for a construction loan. Once all the documentation is received, the lender will have a decision in a few days to a few of weeks. After approval, you’ll pay the bank closing costs and the downpayment. At the start of construction, money needed for the contractors to get started will come from the downpayment that you gave the bank. After the downpayment funds are exhausted, you’ll begin drawing funds from your construction loan. This is called a draw or a bank draft. Draws will follow a draw schedule, which is just a construction term for a payment schedule. Money is disbursed by the lender based on that pre-established draw schedule.

A certain amount of money will be released upon completion of different phases of construction— when the foundation is complete, for example, and upon completion of the framing, and so on. Before funds are released, the lender has someone from the bank check on the home’s progress.

You won’t start making payments on the construction loan until you begin drawing funds. During construction, you’ll be expected to make interest-only payments on the funds that have been drawn. So your loan payments start small and grow, as progress is made on the house and more money is released. The faster the construction is completed, the less you will pay in interest. Ok, now let’s talk about the main types of construction loans. They come in 2 basic varieties: One-Step Loans and Two-Step Loans A one-step construction loan is also called a one-time close loan, or a construction to permanent loan. This is the most sought after type of construction loan, but they may not be widely available in some regions. A one step loan is two loans in one. It includes the temporary construction loan and the long term mortgage. The same lender is used for the construction loan and for the mortgage. The biggest advantage of a one-step, construction-to-permanent loan is that you fill out all the paperwork for both loans just one time. When the house is complete, and a certificate-of-occupancy has been issued, and when all the contractors have been paid in full, the construction loan rolls over into a 30 or 15 year mortgage. When you close on a one-step loan, you are closing on the construction loan and the permanent mortgage at the same time. Since the lender combines the construction loan and the mortgage into a single loan with one closing, you save time. You also save money because you don’t have to pay closing costs on two separate loans. One step loans are best for those who’ve done a lot of planning before they start construction— people who are fairly certain about how large of a house they want and people who have chosen most of their materials and fixtures up front, so they have a pretty good handle on how much their house will cost. The one step loan is also for those who have a pretty good estimate of the time it will take to build their house, remembering to take into account delays that may occur due to weather, and other unforeseen circumstances. For those who want to plan and pick out materials during the construction process, the one step, construction to permanent loan is probably not the best fit. That’s because making significant changes to the terms of the loan is difficult. If you want to add a bedroom, or upgrade several materials and appliances, for example, you’ll either need to pay cash for those changes or take out a separate loan, including the associated closing costs. One step loans usually have very little wiggle room to increase the loan amount. It’s also difficult to increase the length of the loan. There may be penalties to pay if construction exceeds 12 months. So, if you don’t have a well thought out plan for construction, or if you’re someone who prefers to make decisions on the fly, consider a two step loan, which is more flexible. With a two-step loan, you have 2 separate loans—a temporary construction loan and a long term mortgage. There are also 2 separate closings with 2 sets of closing costs. But again, you have more flexibility with final cost of the home and the time line for building with a two step loan. You can make changes, within reason, to the scope of the home without significantly affecting your loan. Lenders usually allow for a 5-10% increase in the original loan amount because they expect overages. And you can also be a bit looser with the construction schedule. With a two-step loan, it’s easier to extend the construction loan. If you want to use the same lender for the two separate loans, you can, but you don’t have to. Shop around for the best rates. Two step loans will often have better rates than one step loans. Whether they prefer a one step or two step loan, many people wonder if they need to sell their current house before they get approved for a construction loan? Well, it depends. The bank wants to make sure that you can make payments on all the loans you take out. So, if the bank determines that you can’t handle the debt of your current mortgage and a construction loan, you won’t be approved for a construction loan until you sell your current house. In that case, you can rent an apartment or house before and during construction. For those with an appropriately low debt to income ratio (meaning they have sufficient income to handle the amount debt they have), for those people, the bank usually will approve the construction loan while they carry their current mortgage. But they’ll still have a decision to make… Even if you have the option of staying in your current house during construction, you’ll have to decide if that’s the best decision. There are pros and cons to selling your current house after your new house is finished, and there are pros and cons to selling the current house before your new house is finished. If you wait until your new house is complete before you sell your old house, you may have several months where you are paying 2 mortgages if your old house doesn’t sell immediately. But, you’ll only have to move once. If you sell your current house before construction is finished, you’ll only have one mortgage to pay, but you’ll have to move twice— once into a temporary house, then again into you newly constructed home. You’ll have to decide which is the lesser of 2 evils for you— paying two mortgages or moving two times. Before getting too far along with acquiring a lot and house plans, it makes sense to find out how much you can borrow, so get pre approved, just like you would if you were buying an existing home. Once you know how much you can borrow, you can tailor your house design to your budget. Start by talking with a loan officer from your own bank or credit union. Pre-approvals typically last for only 30 to 90 days, but it’s smart to get pre approved up to a year before you’re supposed to build to give you a general idea of your budget. Otherwise, you may waste time, money and emotion designing a dream house that you can’t afford. Figuring out what your budget will be by getting pre approved will help you make better decisions. One final word…after you get approved for a construction loan, make sure you don’t go on a spending spree. Buying big ticket items will negatively impact your debt to income ratio, and the could compromise your construction loan. Well, hopefully you have a better idea about financing the construction of your new home. Let’s do a couple quiz questions to test and review what you’ve learned. QUIZ 1. True or False? A conforming loan is also called a jumbo loan. That’s false. A non-conforming loan is also called a jumbo loan. It’s a loan that’s $424,100 or more. It’s more difficult to secure a non-conforming loan because the rules and criteria for securing that type of loan are stricter. A conforming loan is one that is less than $424,100 2. Which is the advantage of a one step, construction to permanent loan? A. There is only one closing which saves time and money B. There are 2 closings so you can choose two lenders C. A one step construction loan give you more flexibility in the loan amount D. A one step construction loan gives you more flexibility in the length of construction loan The answer is A. With a one step loan, also called construction to permanent loan, there is one closing, one lender and you only have to fill out paperwork for approval once. The temporary construction loan is rolled into a 30 or 15 year mortgage after construction is complete. The one step construction loans saves you time and money, but it’s not very flexible. There is very little wiggle room if you want to increase the loan amount or building timeline. If you want more flexibility, choose a 2 step construction loan. You’ll spend more time and money during the approval process and at the 2 separate closings, but you’ll have more flexibility with the loan amount and construction schedule. Please remember that the purpose of this podcast is simply to educate and inform. It is not a substitute for professional advice. The information that you hear is based the only on the opinions, research and experiences of my guests and myself. That information might be incomplete, it’s subject to change and it may not apply to your project. In addition, building codes and requirements vary from region to region, so always consult a professional about specific recommendations for your home. Thank you for joining me this week. I hope you learned as much as I did. Join me on Facebook and join me next week for another episode of Build Your House Yourself University--BYHYU.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

RSS Feed

RSS Feed